japan corporate tax rate 2018

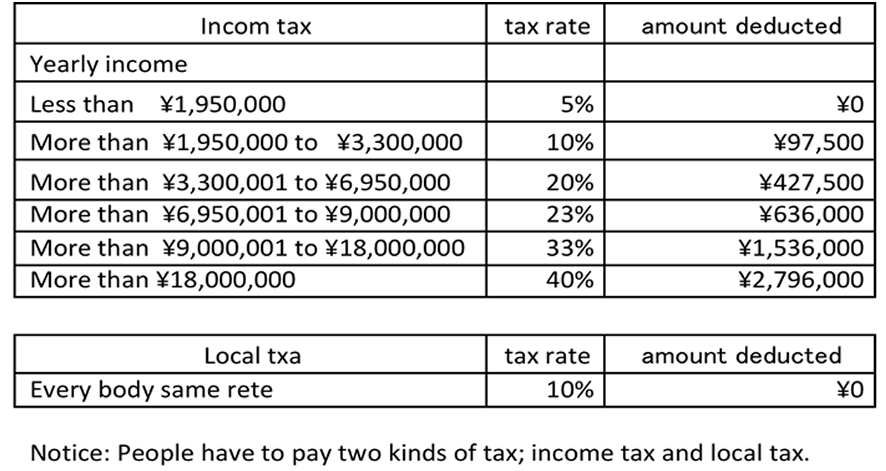

Income from 1950001 to. Income from 0 to 1950000.

Pro And Con Corporate Income Tax Rate Britannica

Effective Statutory Corporate Income Tax Rate.

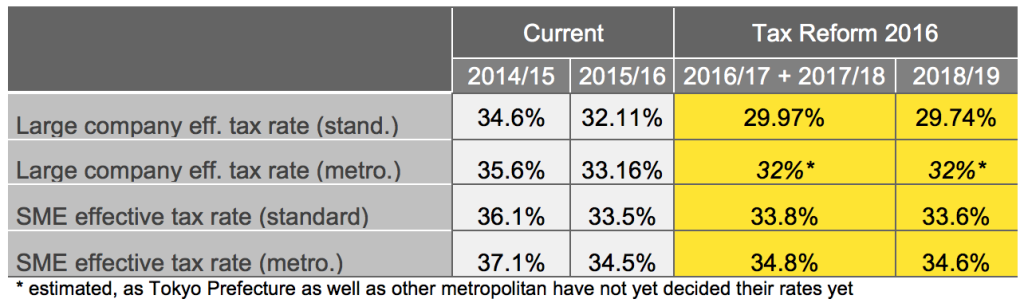

. Tax year beginning between 1 Apr 201731 Mar 2018. 14 14 Taxable Year of Companies. Tax rates The tax rate is 232.

60 of taxable income. Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent. Below we will be referring to Japan corporate tax rates with a fiscal year commenced between 1 April 2018 and 31 March 2019 with references to information from.

Regular business tax rates vary between 16 percent and 372 percent depending on the tax base taxable income and the location of the taxpayer. Tax year beginning after. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

The maximum rate was 524 and minimum was 3062. The tax rate for small and medium-sized enterprises with the capital of 100 million yen or less is 15 for those with an annual income of 8 million yen or less and 234. Effective Statutory Corporate Income Tax Rate.

Japan Income Tax Tables in 2018. The Corporate Tax Rate in Japan stands at 3226 percent. Japan 255 255239 as from 1 April 2015 239234 as from 1 April 2016 234 234 232 as from 1 April 2018 Jersey 010 010 010 01020 01020 Jordan.

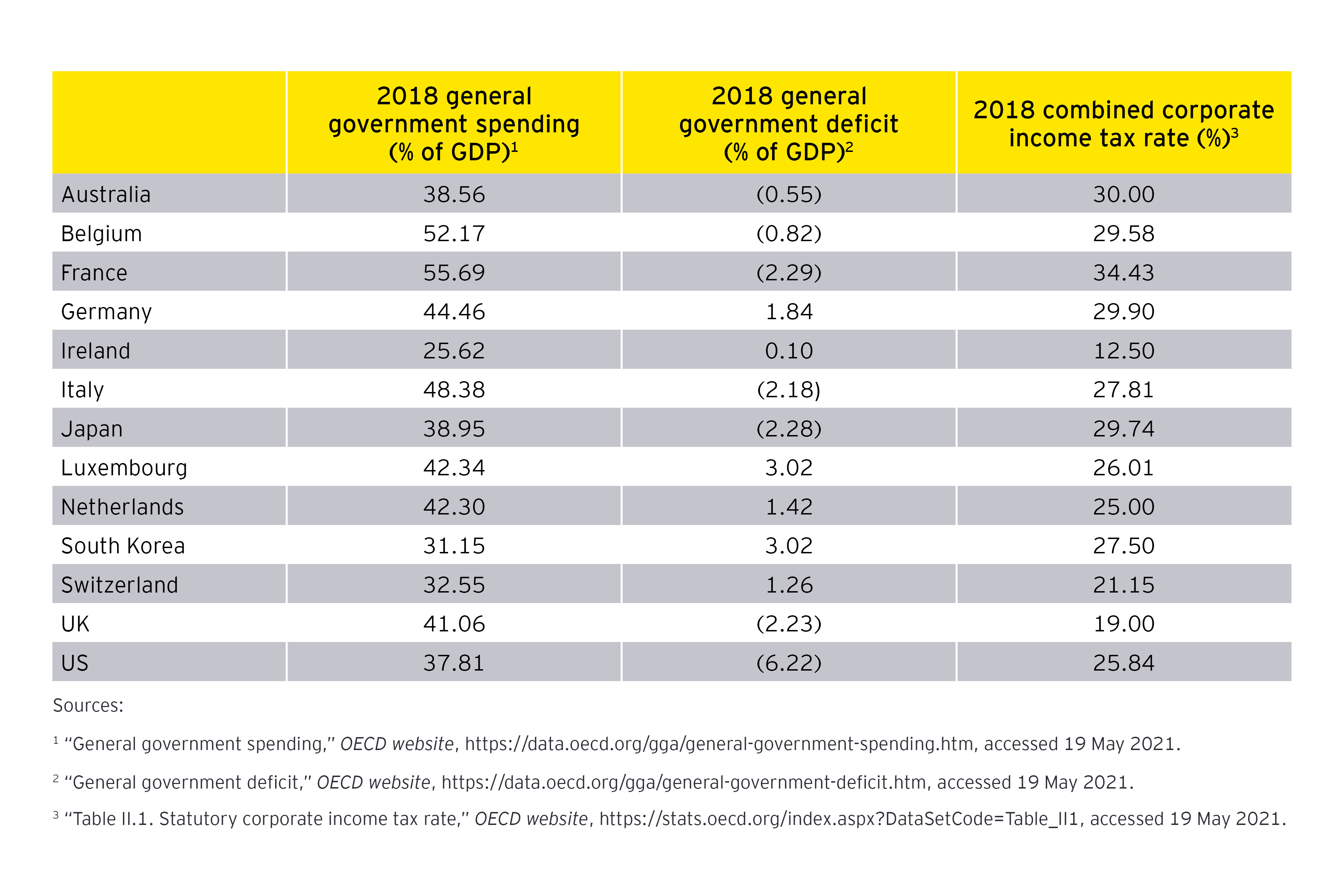

In fiscal 2018 it was 261 percent in terms of national and local taxes combined 160 percent for national tax and 101 percent for local tax. The local standard corporate tax rate in. Data published Yearly by National Tax Agency.

The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and. Special local corporate tax rate is 935. 15 15 Taxable Income.

Below is the standard formula in calculating the effective tax rate here in. An under-payment penalty is imposed at 10 to 15 of additional tax due. Corporate Tax Rate in Japan averaged 4296 percent from 1993 until 2016 reaching an all time high of 5240 percent.

Final tax return Corporations are. The rate is increased to 10 to 15 once the tax audit notice is received. 55 of taxable income.

Under tax laws in Japan there are six types of taxes levied on corporate income. Paid-in capital of over 100 million. Business year A business year is the period over which the.

5 rows Corporation tax rate 1 April 2016. Tax year beginning between 1 Apr 201631 Mar 2017. For a company with capital of 100 million or less a lower rate of 19 is applied to an annual income of 8 million or less.

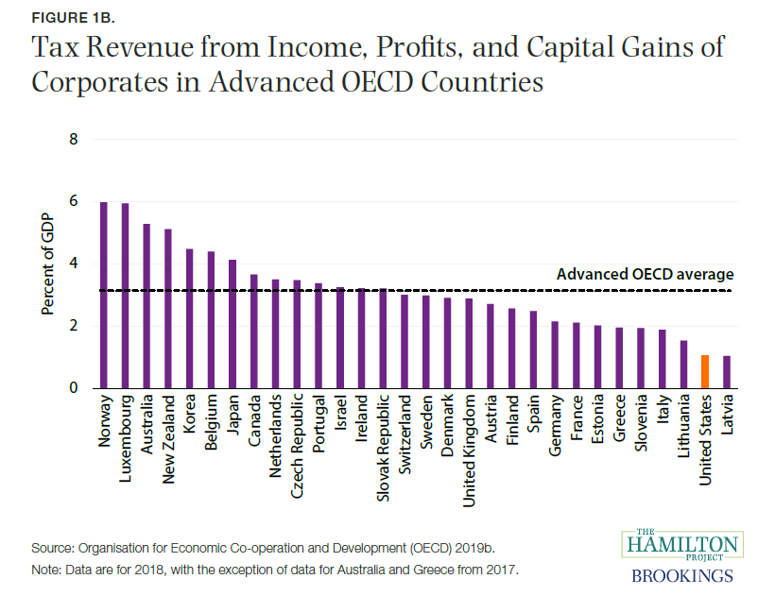

Japans ratio is lower in. Dividends paid by a corporation to a foreign shareholder are generally subject to a 2042 domestic rate withholding tax unless a treaty applies to reduce the withholding tax. Tax Rate applicable to fiscal years beginning between 1 April 2016 and 31 March 2018.

In the case that a. Corporate tax in Japan.

Japan General Account Spending 2021 Statista

Corporate Tax Rates Around The World Tax Foundation

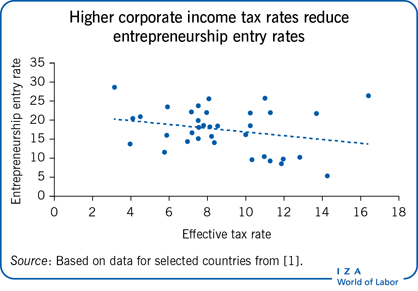

Iza World Of Labor Corporate Income Taxes And Entrepreneurship

How Important Is Tax Competition To India International Tax Review

What The Largest Tax Overhaul In 30 Years Means For Companies Crain S Cleveland Business

Why The New Corporate Tax Rate Is Not As Simple As It Sounds

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Data Shows Largest Firms Benefited Most From India S Corporate Tax Cuts

Corporate Tax In The United States Wikipedia

Brookings And Progressivity The S Corporation Association

Changes In Corporate Effective Tax Rates During Three Decades In Japan Sciencedirect

Corporate Tax In The United States Wikipedia

Japan S Kan Seeks Corporate Tax Cut Wsj

How The Big Tax Reboot May Impact Singapore Ey Singapore

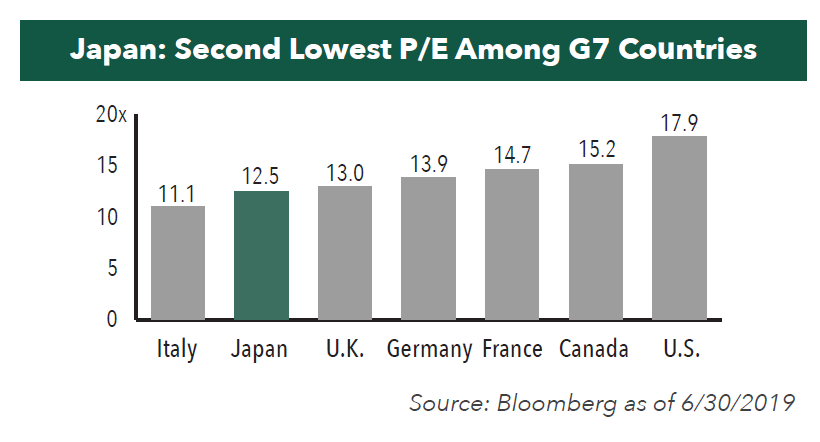

High Quality Japanese Companies At Attractive Valuations Hennessy Funds

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo